Thinking about buying a home? We've got you covered

Get expert advice today

Buying a property in Dubai is exciting, but it also comes with a checklist of legal steps you need to complete - especially if you're financing your home with a mortgage. One of the most important steps is mortgage registration, which makes your loan legally binding and ensures the property is officially tied to your bank until the mortgage is repaid.

If you're wondering what mortgage registration really means, how much it costs, and what you need to do, this guide walks you through everything - step by step.

What Is Mortgage Registration in Dubai?

In simple terms, mortgage registration is the legal process of recording your mortgage with the Dubai Land Department (DLD). This ensures the bank's financial interest in your property is officially recognized by the government.

When you buy a home in Dubai using a mortgage, the bank finances a portion of the purchase price. Until the loan is paid off, the bank is technically part-owner of the property - and mortgage registration ensures this is reflected in the title deed.

Why is it required?

- It's a legal requirement in Dubai.

- It protects the lender's rights in case of default.

- It adds transparency to property ownership records.

- It's needed to complete the property transfer.

Why Is Mortgage Registration Important?

If you're wondering whether you can skip this step - short answer: you can't. Mortgage registration is not just a formality; it offers protection and transparency for all parties involved.

Here's why it matters:

- For buyers: It legally confirms that you've financed the property through a loan and protects you from any disputes about ownership.

- For banks: It gives the lender legal rights to the property until the mortgage is fully repaid.

- For government records: It keeps property transactions transparent and traceable in the DLD system.

Who Needs to Register a Mortgage in Dubai?

Mortgage registration applies to anyone buying property in Dubai using a home loan, including:

- UAE residents and citizens

- Non-resident investors

- First-time buyers and repeat buyers

- Buyers of off-plan properties or completed units

Whether you're looking to buy a villa in Arabian Ranches or an apartment in Dubai Marina, if there's a mortgage involved, registration is mandatory.

Documents Required for Mortgage Registration

Before you can register your mortgage, you'll need to gather and submit a set of documents. Having everything ready makes the process much faster.

Here's what you'll typically need:

- Valid passport copy (and Emirates ID if you're a resident)

- Title deed (for ready properties) or Oqood (for off-plan units)

- NOC (No Objection Certificate) from the developer

- Signed Mortgage Offer Letter from the bank

- Original Sales and Purchase Agreement (MOU/Form F)

- Mortgage Agreement (signed between you and the bank)

- Power of Attorney (if applicable)

Make sure all documents are clear, up-to-date, and preferably in both digital and printed formats.

Mortgage Registration Process: Step-by-Step Guide

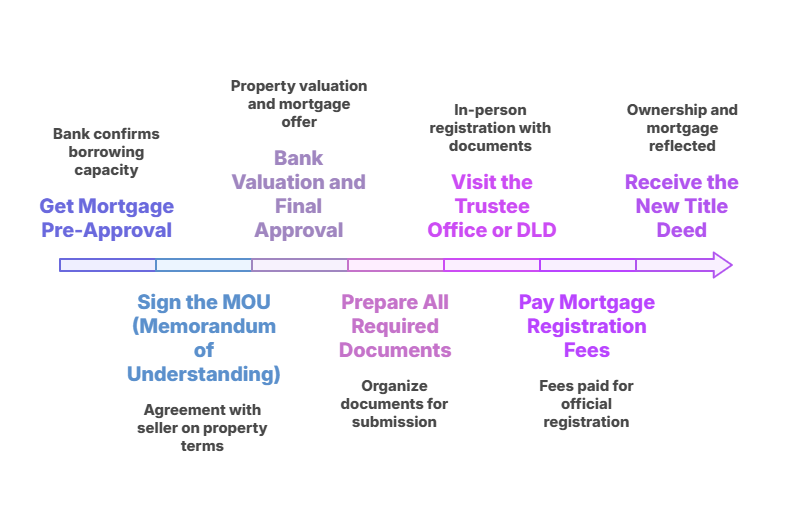

The mortgage registration process in Dubai is fairly straightforward, especially if you're working with a mortgage broker or a platform like Holo. Here's how it typically works:

1. Get Mortgage Pre-Approval

Start by getting pre-approved by your bank or mortgage provider. This confirms how much you can borrow and helps you search for homes within your budget.

2. Sign the MOU (Memorandum of Understanding)

Once you find a property, you'll sign an MOU with the seller. This outlines the terms and conditions of the sale.

3. Bank Valuation and Final Approval

Your bank will arrange for a professional valuation of the property. Once approved, they'll issue a final Mortgage Offer Letter.

4. Prepare All Required Documents

Collect all required documents (listed above). Your mortgage consultant or agent will help you organize these for submission.

5. Visit the Trustee Office or DLD

Head to a DLD-approved Real Estate Trustee Office or the DLD itself with your documents and fees. You can't complete the registration online - you must attend in person or send a Power of Attorney.

6. Pay Mortgage Registration Fees

Fees are paid on the spot (cash, card, or certified cheque). Once completed, the mortgage is officially registered.

7. Receive the New Title Deed

You'll get a new title deed reflecting both your ownership and the bank's mortgage on the property.

The whole process typically takes 1-2 working days if everything is in order.

Mortgage Registration Fees in Dubai

Let's break down the costs involved in registering a mortgage in Dubai. While it might seem like a long list, most fees are one-time payments made during the transaction.

Key Mortgage Registration Fees

| Fee Type | Amount |

|---|---|

| DLD Mortgage Registration Fee | 0.25% of the loan amount + AED 290 admin fee |

| DLD Property Transfer Fee | 4% of the property value |

| Real Estate Trustee Office Fee | AED 4,000 (if property < AED 500,000) or AED 5,000 (if > AED 500,000) |

| Knowledge & Innovation Fees | AED 20 |

| Bank Processing/Arrangement Fees | Typically 1% of loan amount (varies by bank) |

| Valuation Fee | AED 2,500 - AED 3,500 (approximate range) |

Some banks may include registration and valuation fees in your mortgage package - always double-check what's covered.

How Long Does Mortgage Registration Take?

In most cases, the process is completed within 1 to 2 working days. However, delays can happen due to:

- Incomplete or incorrect documents

- Delays in bank final approval

- Issues with NOCs or developer paperwork

Registering Mortgages on Off-Plan Properties

Yes, you can register a mortgage on off-plan properties too. In these cases, instead of a title deed, you'll receive an Oqood certificate, which is a pre-title document issued by the DLD for properties under construction.

Things to note for off-plan mortgage registration:

- You'll need a developer NOC and Oqood document

- Mortgage registration still happens at a trustee office

- Title deed is issued after property handover and final payment

Common Mistakes to Avoid

To make the process as smooth as possible, steer clear of these common errors:

- Showing up without original documents

- Not checking if your trustee office is DLD-approved

- Assuming the bank handles everything (you still need to be involved)

- Delaying the process - some deals fall through due to missed registration deadlines

Helpful Tips for a Smooth Experience

Here's how you can avoid headaches and get your property registered quickly:

- Work with a mortgage broker

- Double-check all documents before your appointment

- Choose a trustee office close to you to save time

- Understand who pays what-some fees can be negotiated

- Keep a soft copy and physical copy of every signed document

Conclusion

Mortgage registration might sound complicated at first, but once you understand the process, it becomes just another part of your home-buying journey. From gathering documents to paying the required fees, each step plays a role in legally securing your home and your mortgage.

By being prepared, working with professionals, and staying informed, you'll save time, avoid surprises, and walk away with the keys to your new property - backed by a legally registered mortgage.

Related articles

Buying vs Renting in the UAE: Which One Is Better for You?

How to Cover Additional Fees When Buying a House in the UAE