Thinking about buying a home? We've got you covered

Get expert advice today

Buying a home is a huge milestone, and getting your mortgage application rejected can feel like hitting a roadblock just when you thought you were almost there. But don't worry - a rejection doesn't mean your dream of homeownership is over. In fact, it's often just a detour, not a dead end. Understanding why your application was rejected and knowing what steps to take next can help you get back on track.

At Holo, we guide you through the mortgage process to help you avoid delays and move closer to securing your new home. In this article, we'll break down the common reasons for mortgage rejection, what to do if it happens to you, and how our home loans experts can support you every step of the way.

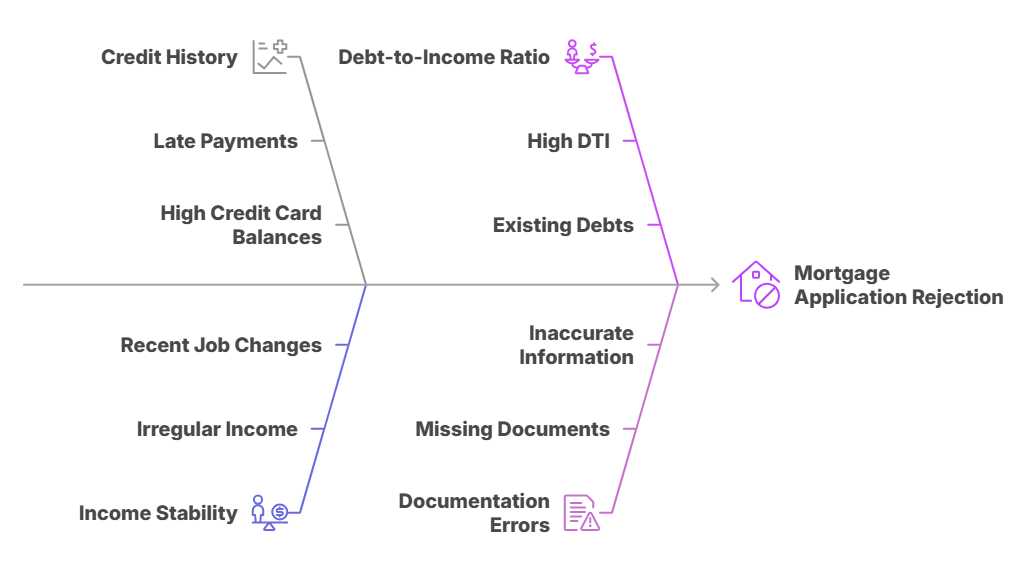

Common Reasons Why Mortgage Applications Get Rejected

Lenders look at several factors to decide whether to approve a mortgage application. Here are the most typical reasons why applications get turned down:

1. Poor Credit History

Your credit score tells lenders how reliable you are when it comes to repaying debt. If you have:

- A history of late payments

- Unpaid debts or defaults

- High credit card balances

These can negatively impact your credit score and raise red flags for lenders. They might worry that you won't make your mortgage payments on time.

2. Insufficient Income or Employment Instability

Lenders need to see that you have a stable income to cover your mortgage payments. Issues like:

- Irregular or inconsistent income

- Recently changing jobs without a stable employment history

- Lack of proof of income if you're self-employed

can make lenders hesitant because they're unsure of your ability to make consistent payments.

3. High Debt-to-Income Ratio (DTI)

Your DTI ratio compares your monthly debt payments to your income. A high DTI means you're spending a large chunk of your income on existing debts, leaving less room for new obligations like a mortgage.

Lenders typically prefer a DTI of 36% or lower. If your DTI is too high, they might reject your application.

4. Incomplete or Inaccurate Documentation

Simple mistakes can cause big problems. Missing or incorrect paperwork can lead to delays or outright rejection. Common issues include:

- Missing bank statements

- Incomplete tax returns

- Errors in personal information

Lenders rely on these documents to verify your financial health, so accuracy is key.

5. Low Property Appraisal

When you apply for a mortgage, the lender will ha ve the property appraised to ensure it's worth the amount you're borrowing. If the appraisal comes back lower than expected, the lender may not approve the loan because the property isn't enough to secure it.

6. Recent Financial Changes

If you've recently:

- Taken on new debt (like a car loan or credit card)

- Made large purchases

- Changed your spending habits significantly

These changes can affect your financial profile, making lenders reconsider your application.

7. Issues with the Mortgage Application Itself

Sometimes, the problem is simply an error in the application:

- Inconsistent information

- Typos in financial figures

- Omitting important details

Even small mistakes can trigger red flags, so it's important to double-check everything before submission.

What to Do If Your Mortgage Application Is Rejected

Getting a rejection letter can be disheartening, but it's not the end of your journey. Here's how to turn things around:

1. Don't Panic: Rejection Is Common

First, take a deep breath. Mortgage rejections happen to many people, even those with strong financial backgrounds. It's a bump in the road, not a dead end.

2. Understand the Reason for Rejection

Lenders are required to provide a reason for rejecting your application. This is known as an adverse action notice. Carefully review it to understand what went wrong. Was it your credit score? Your income?

Missing documents? Knowing the exact reason helps you focus on what needs improvement.

3. Review Your Credit Report

If your credit history played a role in the rejection:

- Request a copy of your credit report from major credit bureaus.

- Check for errors, such as incorrect accounts or fraudulent activity.

- Dispute any inaccuracies to improve your score.

Improving your credit score might take time, but it's one of the most effective ways to boost your chances of approval next time.

4. Improve Your Financial Profile

Depending on the issue, here are some steps you can take:

- Pay down existing debts to lower your DTI ratio.

- Build your savings to show financial stability.

- Avoid large purchases while preparing to reapply.

- Maintain stable employment and keep thorough income records.

5. Seek Professional Guidance

This is where Holo can make a big difference. Our experts:

- Analyze your rejection letter

- Review your financial situation

- Provide personalized advice on what to fix

With our support, you can avoid common mistakes and reapply with confidence.

6. Consider Alternative Lenders or Loan Options

Not all lenders have the same criteria. If one lender rejects you, another might approve your application based on different guidelines. We can help you identify lenders that are more likely to say "yes". You can also explore different types of loans that might suit your financial profile better.

7. Prepare for a Stronger Reapplication

Once you've addressed the issues:

- Double-check all your documents

- Ensure your financial profile is as strong as possible

- Highlight any improvements since your last application

With these steps, your next application will be much stronger.

Final Thoughts

A mortgage rejection can feel discouraging, but it's often just a step in the process, not the end of the road. By understanding why your application was rejected, taking the right steps to improve your financial profile, and seeking expert guidance, you can turn that "no" into a "yes".

At Holo, we're committed to helping you achieve your dream of homeownership without unnecessary delays. Our team of experts is ready to guide you through the process, identify potential issues, and help you reapply with confidence.

Need help figuring out your next steps? Contact our mortgage experts today to get back on track toward securing your dream home

Related articles

Mortgage Registration in Dubai: Process, Requirements And Fees Explained

Buying vs Renting in the UAE: Which One Is Better for You?