Thinking about buying a home? We've got you covered

Get expert advice today

Buying a home in the UAE is a major milestone, but protecting it is just as important. That's where homeowners insurance comes in. Whether you're living in your property or renting it out, having a proper insurance policy can help you sleep better at night.

From burst pipes and kitchen fires to theft and natural wear, unexpected damages can turn into major costs. Fortunately, a good insurance policy doesn't just cover the structure of your home but it also protects your personal belongings, offers liability coverage, and helps with temporary accommodation if needed.

In this guide, you'll learn everything you need to know about house insurance in the UAE.

What Is House Insurance?

Homeowners insurance (also called home insurance) is a policy that provides financial protection for your home and belongings. Depending on the type of coverage you choose, it can:

- Cover the cost of repairs or rebuilding after damage

- Replace stolen or damaged belongings inside your home

- Protect you from liability if someone is injured on your property

- Pay for temporary housing if your home becomes unlivable due to a covered incident

Think of it as a safety net that helps you recover financially if something goes wrong.

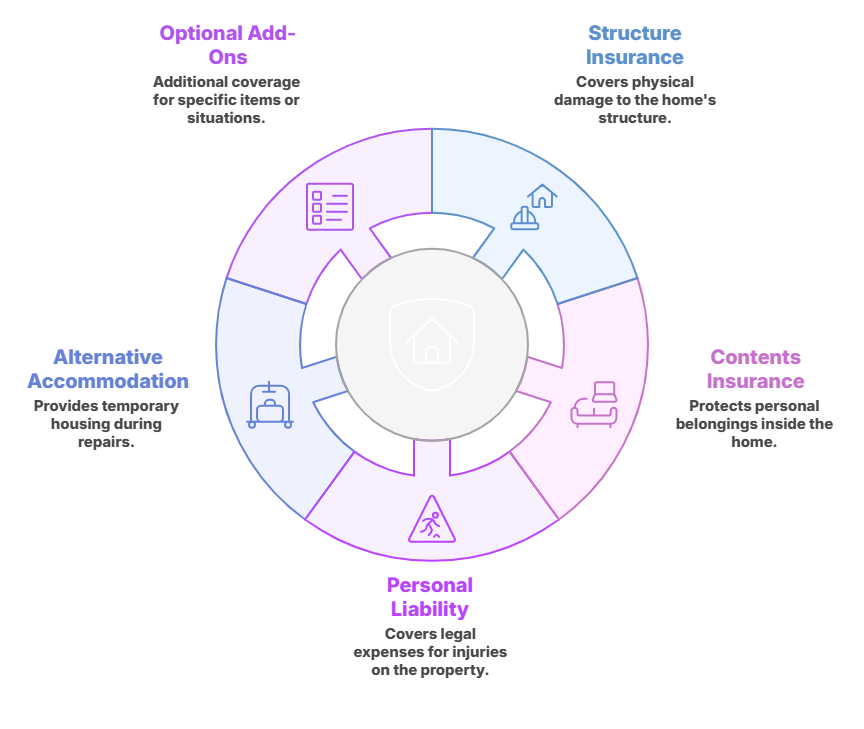

What Does House Insurance Cover?

It protects you from the financial burden of damage or loss to your home and its contents. Policies in the UAE typically cover the following:

1. Structure/Building Insurance

This protects the physical structure of your property, including:

- Walls, roofs, ceilings

- Flooring and tiling

- Fitted kitchens and built-in wardrobes

- Electrical wiring and plumbing systems

If your home is damaged due to fire, burst pipes, or other covered incidents, building insurance will help cover the cost of repairs or rebuilding.

2. Contents Insurance

Covers the items inside your home, including:

- Furniture (sofas, beds, tables)

- Appliances (refrigerators, washing machines)

- Electronics (TVs, laptops, phones)

- Clothing, jewelry, personal items

Some policies also include coverage for accidental damage, theft, or loss.

3. Personal Liability Coverage

If someone is injured in your home (for example, a visitor slips and falls), this part of the policy covers legal expenses and potential compensation claims.

4. Alternative Accommodation

If your home becomes uninhabitable due to a covered event (like a major fire or flood), your insurance can pay for temporary accommodation while repairs are underway.

5. Optional Add-Ons

Depending on your provider, you may also be able to add:

- Home office equipment

- High-value items like artwork or luxury watches

- Coverage for maid or domestic worker belongings\

Is Homeowners Insurance Mandatory in Dubai or the UAE?

In short: It depends.

Not Required by Law

The UAE does not legally require homeowners to purchase insurance. However, it's highly recommended for all property owners and tenants, especially in high-value areas like Downtown Dubai, Dubai Hills Estate, and Palm Jumeirah.

Required by Mortgage Providers

If you're buying a property with a mortgage, your bank will likely require building insurance as part of the loan agreement. This protects the lender's investment in case of structural damage.

Optional for Tenants and Cash Buyers

If you're renting a property or buying with cash, you're not obligated to buy insurance. Still, it's a smart investment to protect your belongings and cover liabilities.

Most Common Types of Homeowners Insurance Policies

Choosing the right type of policy depends on whether you own, rent, or lease out the property. Here are the most popular options in the UAE:

1. Building Insurance

Covers damage to the physical structure of the property. Often required for homeowners with a mortgage.

2. Contents Insurance

Protect your personal belongings inside the home. Ideal for both owners and renters.

3. Combined Building and Contents Insurance

A comprehensive policy that covers both the structure and the contents. Ideal for owner-occupiers.

4. Landlord Insurance

Specialized coverage for owners renting out their property. May include protection against rent loss, property damage, and third-party liability.

5. Tenant's Insurance

Covers tenants' belongings and may include accidental damage or liability coverage.

How Much Does Home Insurance Cost in the UAE?

The cost of homeowners insurance varies depending on the size of the property, the level of coverage, and the insurance provider. Here's a general idea of what you can expect to pay annually:

| Type of Property | Insurance Type | Estimated Cost (AED/year) |

|---|---|---|

| Studio Apartment | Contents Only | 200 - 400 |

| 1-Bed Apartment | Contents Only | 300 - 600 |

| 2-Bed Apartment | Combined | 700 - 1,200 |

| 3-Bed Villa | Combined | 1,200 - 2,500 |

| Rented Apartment | Tenant Insurance | 250 - 500 |

Factors That Affect Premiums:

- Property value and size

- Type of policy (building, contents, or combined)

- Location and community

- Home security features (alarms, CCTV, guards)

- Level of coverage and optional add-ons

- Claim history or existing damage

Tip: Always get quotes from at least three providers and compare both the price and the scope of coverage.

What to Look for When Choosing a Home Insurance Policy

Not all insurance policies are created equal. Here's what you should pay attention to:

1. Coverage Limits

Check how much the insurer will pay in case of a claim. Some policies have maximum limits for certain items like jewelry or electronics.

2. Exclusions

Be clear on what isn't covered. Common exclusions include:

- Gradual wear and tear

- Flooding or storm damage (unless specified)

- Damage caused by poor maintenance

- War or terrorism-related incidents

3. Excess or Deductibles

This is the amount you'll need to pay out of pocket before your insurance kicks in. A higher excess can lower your premium but means you'll pay more when claiming.

4. Claim Process and Support

Look for providers with a smooth, digital-friendly claims process and 24/7 customer support.

5. Add-Ons and Flexibility

Choose policies that let you tailor your coverage with optional extras like:

- Home business equipment

- Valuables and luxury items

- Domestic worker cover

How to Get Homeowners Insurance in the UAE

There are several ways to apply for home insurance:

1. Directly from Insurance Providers

Many UAE insurers like GIG, AXA, RSA, Orient, and Sukoon (formerly Oman Insurance) offer home insurance packages through their websites or branches.

2. Via Insurance Brokers

Brokers help you compare policies and advise on the best coverage based on your situation. This can save time and effort, especially if you're not familiar with insurance terms.

3. Through Your Bank or Mortgage Provider

If you're buying with a mortgage, your bank might offer insurance as part of your loan package. Be sure to compare this with outside providers to make sure you're getting the best deal.

Required Documents Typically Include:

- Passport and Emirates ID

- Property ownership documents or tenancy contract

- Home value and contents estimate

- Floor plan (for larger villas or high-value homes)

Conclusion

Whether you're a homeowner, landlord, or tenant, getting home insurance in the UAE is one of the smartest moves you can make. It protects your home, your belongings, and your peace of mind.

The good news? Home insurance in the UAE is relatively affordable, easy to set up, and customizable to your needs.

Related articles

Best AI Tools for Real Estate Agents in Dubai: The 2025 Playbook to Close More Deals

How to Invest Money in the UAE to Generate Wealth: 2025 Guide