Thinking about buying a home? We've got you covered

Get expert advice today

Buying a home overseas might seem daunting, but if you're an Australian looking to invest in Dubai's thriving property market, you're not alone. Dubai is one of the few international real estate markets that actively encourages foreign investment, and Australians are increasingly turning to this tax-free city for both lifestyle and financial opportunities.

Whether you're looking for a high-yield investment property or a second home in the UAE, this guide will walk you through everything you need to know to buy a house in Dubai from Australia including legal requirements, financing options, and common pitfalls.

Why Australians Are Investing in Dubai Property

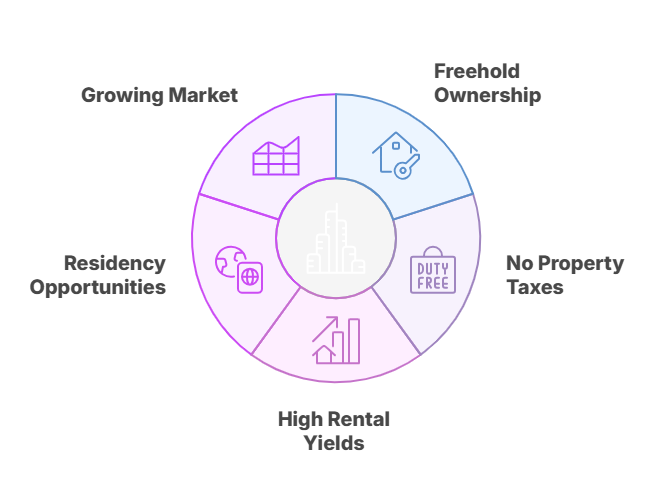

Dubai offers several advantages that make it attractive for Australians:

- Freehold Ownership: Australians can own property outright in designated freehold areas such as Dubai Marina, Downtown Dubai, Jumeirah Village Circle (JVC), and Palm Jumeirah.

- No Property Taxes: Dubai does not levy annual property taxes or capital gains tax, significantly increasing net rental yields.

- High Rental Yields: Investors often see returns between 5% and 9%, depending on the location and property type.

- Residency Opportunities: Investing in real estate worth AED 750,000 or more can make you eligible for a residency visa, with more extended visas available at higher investment thresholds.

- Growing Market: Dubai property prices have continued to rise year-on-year, supported by population growth, business-friendly reforms, and demand from international buyers.

Understanding the Dubai Property Market

Before diving in, it's important to understand how the Dubai real estate market works. The Real Estate Regulatory Agency (RERA) governs real estate practices, and the Dubai Land Department (DLD) manages property transactions. These institutions ensure transparency and security for both residents and foreign investors.

Dubai offers a range of property types: from apartments in high-rise buildings to villas in gated communities and off-plan properties in new developments. The city is also segmented into freehold and leasehold areas. As a foreigner, you can buy property in designated freehold zones with full ownership rights.

Popular areas for Australian buyers include:

- Downtown Dubai: Close to major landmarks, luxury retail, and offices.

- Dubai Marina: Waterfront living with easy access to the beach.

- Palm Jumeirah: Iconic development with high-end villas and apartments.

- Jumeirah Village Circle (JVC): Affordable options and high rental returns.

Step-by-Step Guide to Buying a Property in Dubai from Australia

1. Define Your Objective

Are you buying for investment, as a holiday home, or planning to relocate? Your goal will influence the type of property, location, and financing you pursue.

2. Set Your Budget

Property prices in Dubai vary widely. Apartments in JVC may start around AED 500,000 (~AUD 205,000), while villas in Palm Jumeirah can exceed AED 10 million (~AUD 4.1 million). Remember to account for transaction fees (roughly 7% of the property price) and currency exchange fluctuations.

3. Choose a Trusted Buyer's Agent

Work with a buyer's agent. This ensures you're dealing with a registered professional and protects you from scams. Many agents in Dubai cater to overseas buyers and can handle most of the process remotely.

4. Research Financing Options

Cash Buyers: The most straightforward path. Many developers offer discounts for cash payments, and you can avoid interest costs.

Mortgages for Non-Residents: Some UAE banks lend to non-residents, usually covering up to 50% of the property's value. You'll need to provide documents like passport copies, proof of income, credit reports, and bank statements. Interest rates typically range from 3.5% to 6%.

Off-Plan Payment Plans: Developers often offer flexible post-handover plans, especially for off-plan properties. These can involve 5- to 10-year schedules.

5. Make an Offer and Sign an MOU: Once you find a property, your agent will help you draft a Memorandum of Understanding (MOU), which outlines the sale terms. You'll need to place a 10% deposit, usually held in escrow until the deal is finalized.

6. Conduct Due Diligence: Ensure the property is free of liabilities and check the developer's or seller's credentials. For off-plan properties, confirm that the project is registered with RERA and the DLD.

7. Finalize the Transaction: You and the seller (or your representatives) will visit the DLD to complete the transfer. You'll pay the remaining balance, along with the DLD transfer fee (4%) and agent commission (~2%). Once completed, you'll receive the title deed in your name.

8. Post-Purchase Steps: Set up DEWA (utilities), arrange for property management if you're not living in Dubai, and register with the local municipality. If you plan to rent the property, your agent or a third-party manager can help you find tenants and manage the lease.

Legal and Visa Considerations

- Title Deed: As a foreign buyer, your name will appear on the official title deed issued by the DLD.

- Oqood Registration: For off-plan properties, the Oqood document proves your ownership until handover.

- Residency Visa: Buying property worth at least AED 750,000 may make you eligible for a renewable 3-year investor visa. Properties worth AED 2 million or more may qualify you for a 10-year Golden Visa.

- Inheriting or Selling: Dubai follows Sharia law unless a will is registered with the DIFC Wills Service Centre, which ensures the property is distributed according to your wishes.

Taxation and Repatriation

Dubai does not impose income tax on rental income or capital gains. However, you may be liable for tax in Australia. Australian tax residents must declare all foreign income, including rent and capital gains, to the ATO. You might be able to claim deductions or foreign tax credits, so consult a tax advisor to ensure compliance.

For fund transfers, use regulated remittance services or your Australian bank to repatriate rental income or sale proceeds back to Australia.

Common Mistakes to Avoid

- Skipping due diligence: Always verify the legitimacy of the developer or seller.

- Ignoring service charges: These can affect your ROI if not factored into your budget.

- Overleveraging: If you're using a mortgage as a non-resident, don't stretch your finances too thin. Factor in interest, fees, and potential rental vacancies.

- Buying in the wrong area: Don't base decisions solely on price. Consider location, future development plans, and tenant demand.

Conclusion

Buying property in Dubai from Australia is not only possible, it's increasingly popular. With the right preparation, a good agent, and a clear understanding of the legal and financial requirements, you can secure a high-performing investment or a dream holiday home in one of the world's most dynamic cities.

Whether you're investing for returns or lifestyle, take your time, ask the right questions, and always work with reputable professionals, if you are financing working with a trusted mortgage advisor for non-residents is your best option. The process is straightforward, the market is growing, and the opportunities for Australian buyers have never been better.

Related articles

Property Tax in Dubai: Does It Apply?

Property Handover Process in the UAE: Your Step-by-Step Guide to a Successful Transition